We Make Small Business Funding Easy!

Smarter | Faster | Flexible

Apply in Minutes!

Our underwriting process is lightning fast, providing approvals faster than most small business lenders can dream of.

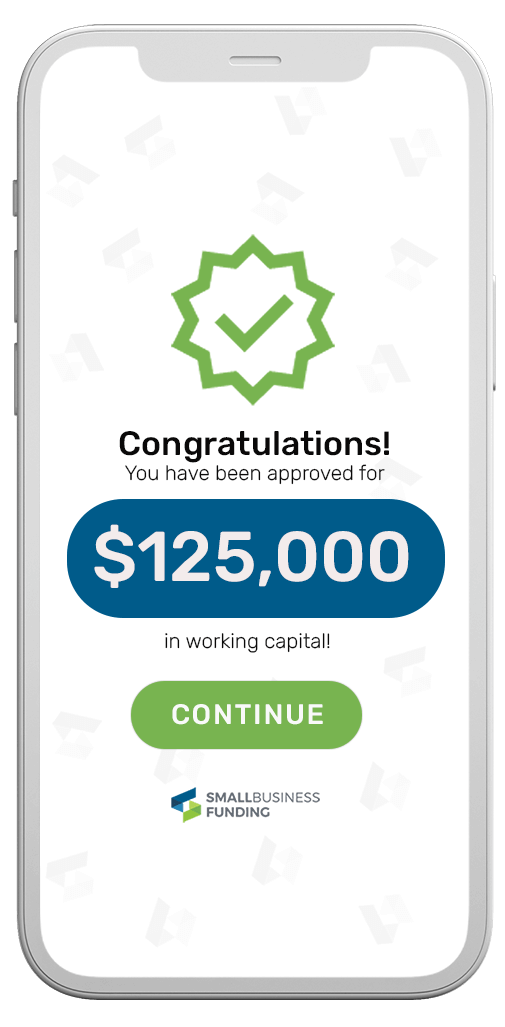

Up to $500,000

We provide up to $500,000 in small business funding, and we do it FAST.

Receive Funding in 48 to 72 Hours

Yes, many approvals are made in as little as 48 to 72 hours. Traditional banks take weeks, even months.

Do You Have Bad Credit? We Have Options.

While your personal credit score is a factor, it is not the main factor. Each of our lenders in our network weighs credit score differently and most evaluate your current and future business performance more heavily. Even if you have less than perfect credit, you can still get approved! We have numerous products available so don’t be discouraged just because you have less than perfect credit.

More Working Capital…Faster!

Working capital is the lifeblood of any small business. It represents the funds needed to cover a business’s most basic day-to-day expenses. Without adequate working capital, a small business may struggle to pay bills, make payroll, purchase inventory, or invest in growth opportunities, and you always seem to need it…yesterday. Having access to working capital enables a small business to seize opportunities, manage unexpected expenses, and continue operations during periods of slow cash flow. It can also help a business weather economic downturns, allowing them to continue operations until conditions improve. We offer numerous working working capital products with funding available in as little as 48 hours.

Why Choose Us?

Twelve Years…Thousands of Small Businesses Funded

For over 12 years, Small Business Funding has provided thousands of small businesses in Pennsylvania and across the USA with the funding they have needed. As small business owners ourselves, we know how important securing funding is to a business’s survival. We have issued tens of millions of dollars in working capital and many of clients return for additional funding 8, 9, and more than 10 times.

Fast Approvals

Approvals in 24 hours. Funding in mere days.

Streamlined Process

Easy. Simple. Intuitive Process. Our application takes less than 5 minutes to complete.

All Credit Considered

We consider more than just credit when reviewing our applications.

Flexible Options

We offer multiple lending products to businesses to fit their unique needs.

Personal Service

Each business receives a dedicated account representative.

Apply for FREE 24/7

There is no cost or obligation to commit to funding when applying, & you can apply 24/7.

What Small Business Owners are Saying

This is the only company to go to for lending when you need it. We have utilized their services for the last 7 years. The staff is professional, friendly, and they have the information we need when we need it. Highly recommend this group!

Bill McConnell

I enjoyed my experience with both Nicholas and Jon. They helped me navigate through my journey of obtaining our company’s very first business loan. I am super excited about my future with Small Business Funding and how they will assist the growth of our companies, Astute & Studious Business Logistics LLC and Nature’s North Freight Inc!

Darius

Alpha Lab Services

Just a Snapshot of What Makes Small Business Funding Different

10,000+

Businesses Served

$100,000,000+

In Funding Distributed

174

☆☆☆☆☆Trustpilot Reviews

Frequently Asked Questions

How to get funding for a small business?

To get funding for an established small business, it's important to have a solid business plan, financial projections, and a good credit history. Smallbusinessfunding.com offers a streamlined application process, competitive rates, and access to a network of lenders. They also offer personalized support and guidance throughout the funding process.

Is working capital the same as a line of credit?

A working capital loan typically has a term of six to 18 months, whereas a line of credit typically remains open for a year and requires the borrower to pay down the balance to zero at least once. Despite these differences, both types of loans can help prevent the accumulation of paid interest over extended periods.

How does line of credit affect working capital?

A revolving line of credit that is unsecured can serve as a useful means of supplementing your working capital. Such lines of credit are intended to fund short-term working capital requirements and come with more favorable terms than business credit cards. Moreover, your business can borrow only the necessary amount as and when required.

Why Is Working Capital Important?

The significance of working capital lies in its ability to finance a business's daily operations and fulfill its short-term liabilities. Adequate working capital enables a company to sustain its obligations, including payments to suppliers and employees, and cover other expenses such as interest payments and taxes, even during periods of cash flow difficulties.

How can I get small business funding in Pennsylvania?

Small Business Funding is based in Pennsylvania, helping businesses in Pennsylvania get funding with fast approvals and capital in as little as 48 hours.